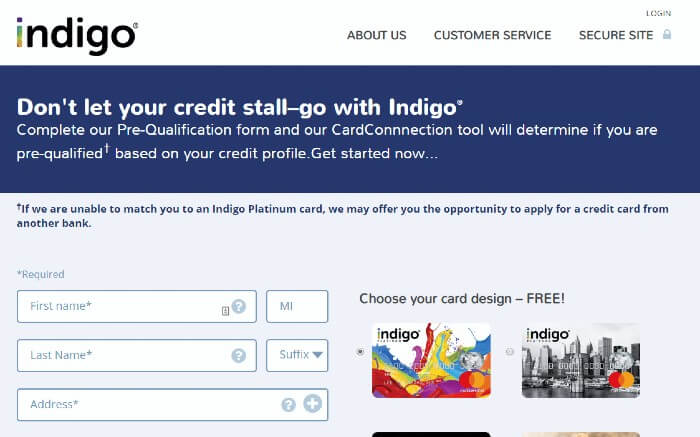

If you're anxious enough to tidy up your credit, this card could, therefore, be an option. Since it's reasonably easy to be approved, Indigo imposes these fees so that you're essentially paying to improve your credit without needing to put down a security deposit. Now, you might be thinking, "A bare-bones card with no perks and one that comes with an annual fee?" There's a method behind the madness. $75 first year annual fee, $99 thereafter.It should be noted that the Indigo card is actually three separate cards, each with its own annual fee, depending on your finances.

The Points Guy will not share or sell your email. I would like to subscribe to The Points Guy newsletters and special email promotions. All in all, this is a basic, no-frills unsecured credit card with the sole intention of increasing your credit score. The Indigo card has fairly high approval odds, and can even be a card candidate for someone that has had a previous bankruptcy. The Indigo Platinum Mastercard is meant for individuals who have bad to fair credit and are eager to improve it. The card details on this page have not been reviewed or provided by the card issuer. The information for the Indigo Platinum Mastercard has been collected independently by The Points Guy. New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter. Let's dig into the details on the Indigo card to see if it could make sense for you. Even for those with poor credit, better options exist. The Indigo Platinum Mastercard, issued by Utah-based Celtic Bank, is one such card that can help in rebuilding credit - but it comes at a cost. However, it's prudent to be knowledgable about what all of those card options are. If you're looking to get on more solid ground when it comes to your financial standing, applying for certain credit cards to build or repair credit can make a lot of sense. This page includes information about the Discover it Secured that is not currently available on The Points Guy and may be out of date. Card Rating*: ⭐⭐ *Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer. A potential annual fee and low credit limit hamper the usefulness of this card as a way to build creditworthiness. However, you'd likely be better served by other non-secured and secured card options. If you have poor credit and are in extreme need of a credit boost, the Indigo card is worth a look. You can use the same on HDFC credit card application status page or IndiGo’s page to see how far your application process has come.Update: Some offers mentioned below are no longer available. How do I check the application status for the 6E Rewards XL IndiGo HDFC Bank Credit Card?Īfter successful application, an application reference number will be shared with you. There is no annual fee Waiver on the 6E Rewards XL IndiGo HDFC Bank Credit Card. 6E Reward Points are valid only up to 2 years from the date of accrual. If your mobile number and email ID are verified, you may use the reward points to make purchases through the website. The rewards can be redeemed only after logging into the membership program. Please note that the 6E Rewards Program is NOT a frequent flyer program. 500Īlso Read: Popular Credit Cards in India 2023ĦE Rewards is the rewards program of IndiGo Airlines through which cardholders can earn rewards on every purchase and then redeem the same to avail privileges across travel and other partner brands. Maximum waiver per billing cycle has been capped at Rs.The card offers a complete waiver of fuel surcharge for transactions above Rs.

0 kommentar(er)

0 kommentar(er)